capital gains tax philippines

First of all your propertys. A tax haven is a jurisdiction with very low effective rates of taxation for foreign investors headline rates may be higher.

How To Compute Capital Gains Tax Train Law Youtube

For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 41675 in 2022.

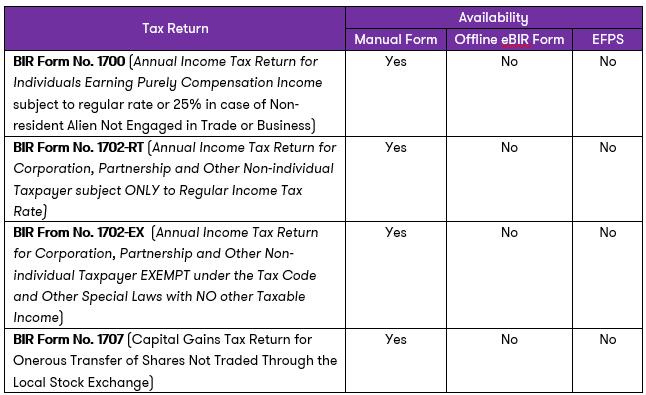

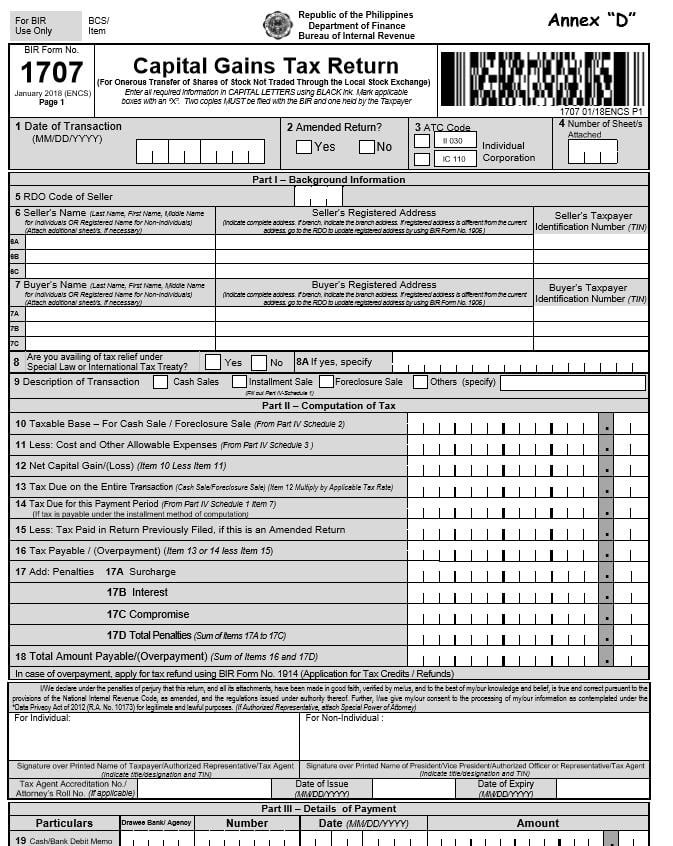

. The Capital Gains Tax Return BIR Form No. Capital gains are subject to IRPF or IRNR taxed at 12 with some exceptions. Uzbekistan Republic of Last reviewed 26 January 2022.

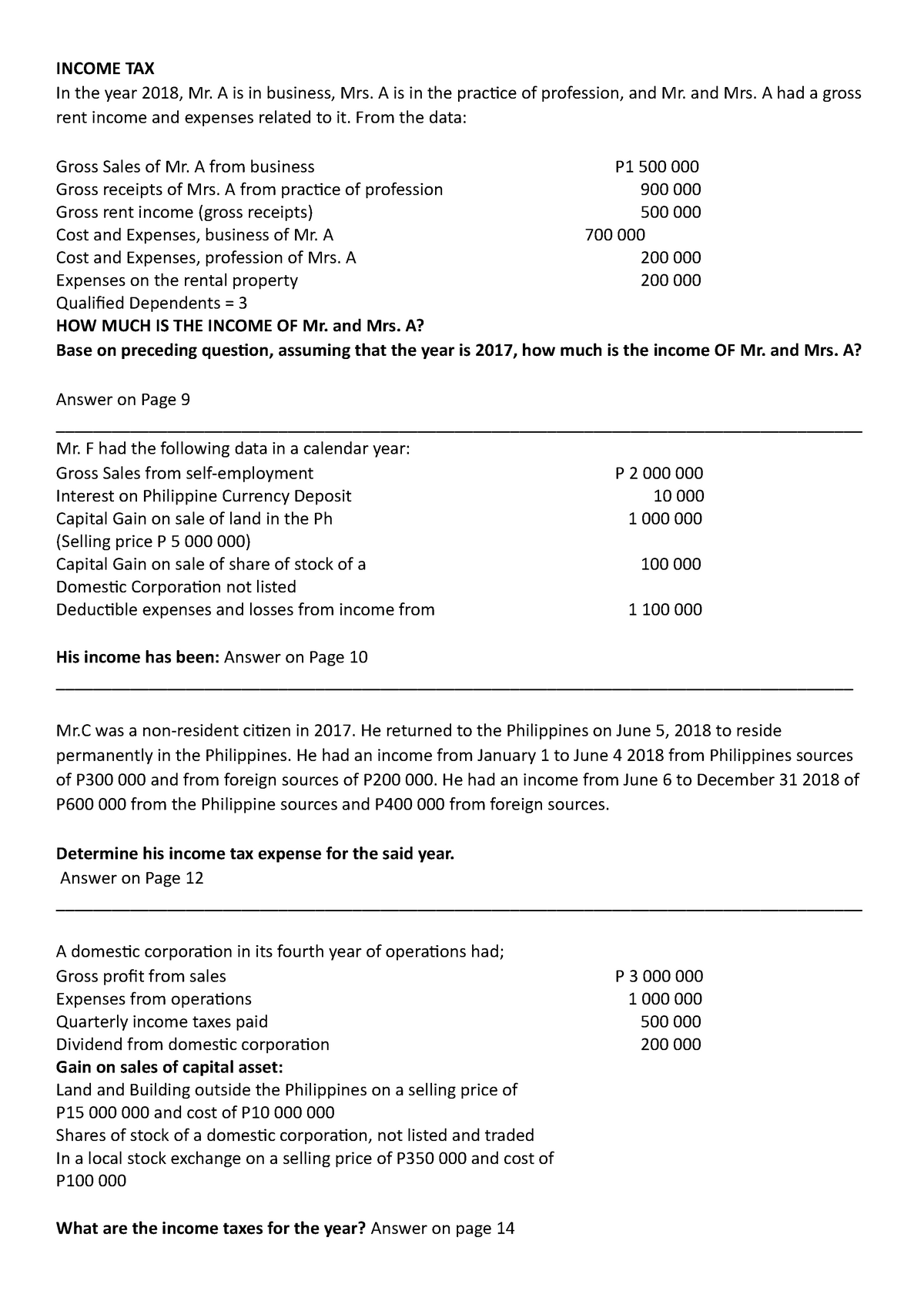

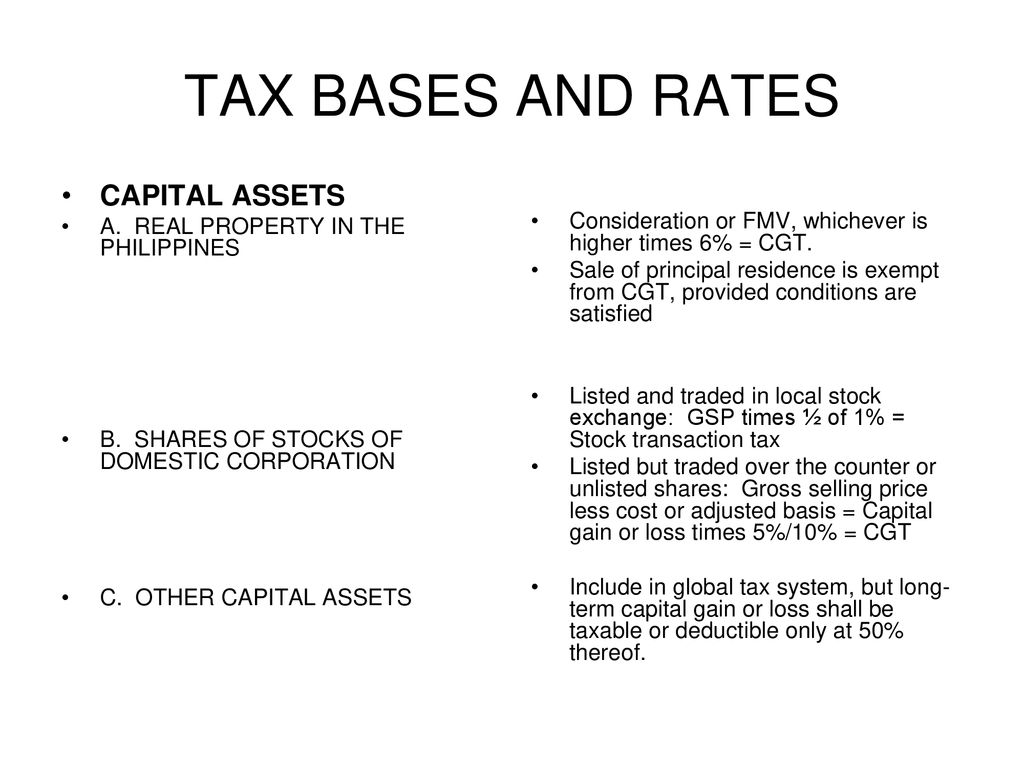

Salary of PHP 652000 living allowances of PHP 100000 and housing benefits 100 of PHP 300000. See RR 7-2003 5 to determine whether a particular real property is a capital asset or an ordinary asset. Capital gains from sale exchange or other disposition of real property located in the Philippines classified as capital asset.

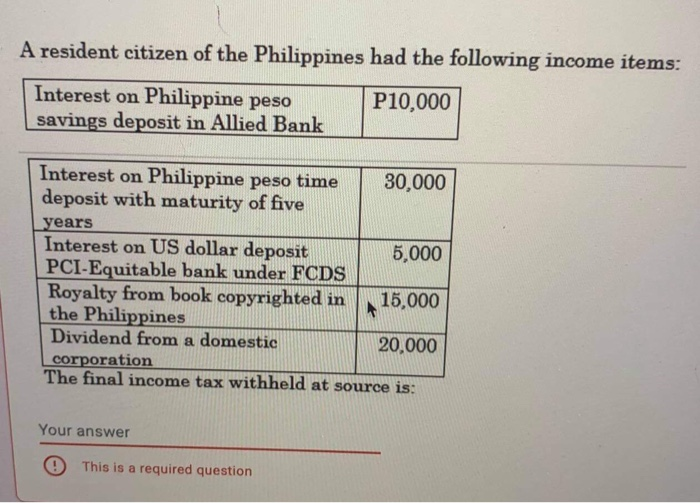

Interest Income from long-term deposit or investment in the form of savings common or individual trust funds. In some traditional definitions a tax haven also offers financial secrecy. However while countries with high levels of secrecy but also high rates of taxation most notably the United States and Germany in the Financial Secrecy Index FSI rankings can be.

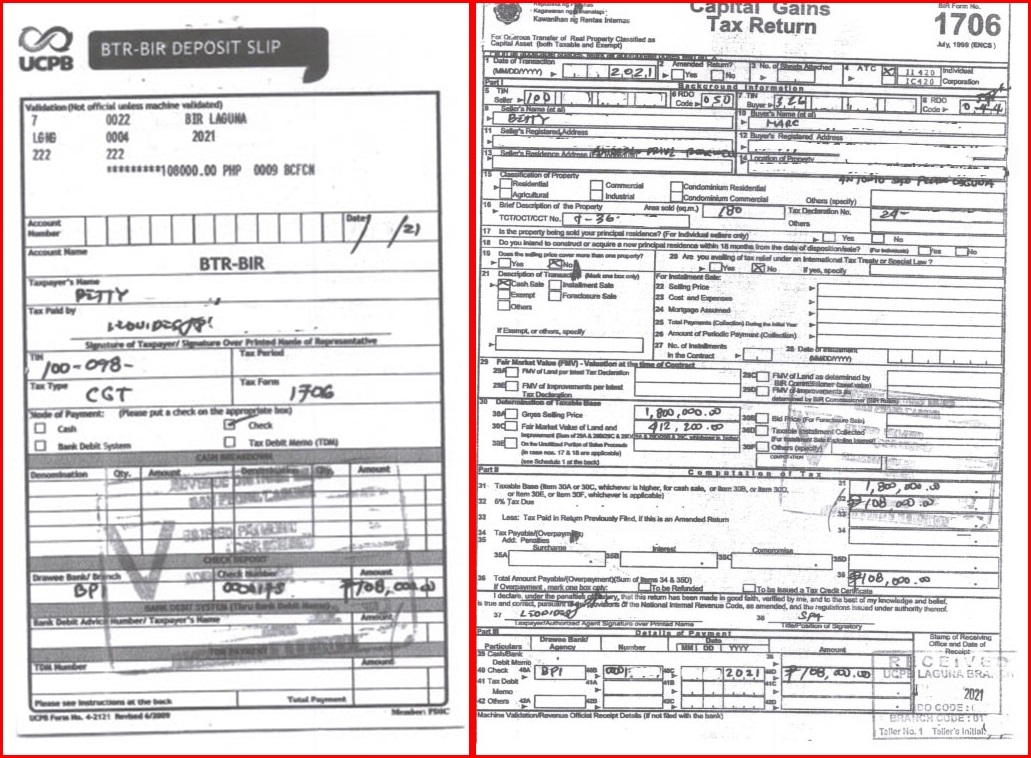

Whenever one of those assets increases in valueeg when the price of a stock you own goes upthe result is whats called a capital gain In jurisdictions with a capital gains tax when a. A 6 Capital Gains Tax is imposed on the presumed gain from the sale of real property based on the gross selling price the BIR zonal valuation or the assessed value of the property whichever is highest. 1706 shall be filed in triplicate copies by the SellerTransferor who are natural or juridical whether resident or non-resident including Estates and Trusts who sell exchange or dispose of a real property located in the Philippines classified as capital asset as defined under Sec.

There is no individual capital gains tax in Uruguay. Capital city the area of a country province region or state regarded as enjoying primary status usually but not always the seat of the government. How to Compute for Capital Gains Tax in the Philippines.

Resident alien husband and wife with two dependent children. 39 A 1 of RA No. Capital gains tax on sale of real property located in the Philippines and held as capital asses is based on the presumed gains.

Capital most commonly refers to. Capital letter an upper-case letter in any type of writing. Calculating capital gains tax on your foreign home.

Sale of real property located in the Philippines. Calculating capital gains tax on your foreign rental property. Capital assets generally include everything owned and used for personal purposes pleasure or investment including stocks bonds homes cars jewelry and art.

Capital economics a factor of production that is not wanted for itself but for its ability to help in producing other goods. The term sale includes. In computing the capital gains tax you simply determine the higher value of the property and simply multiply the same with 6.

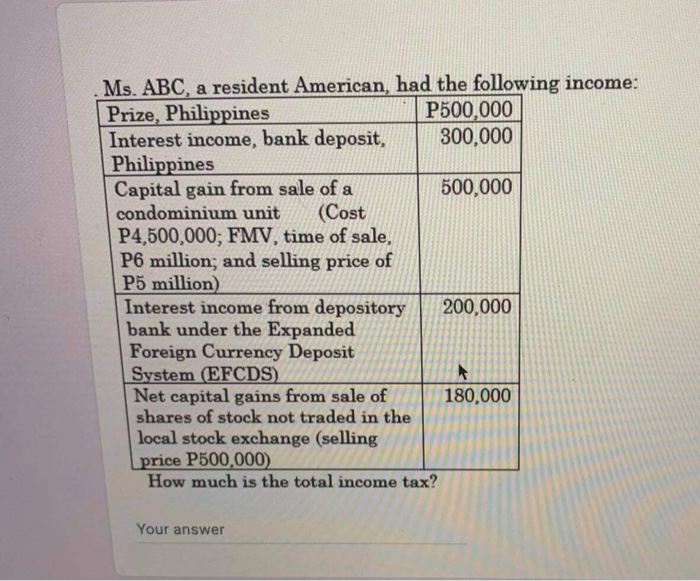

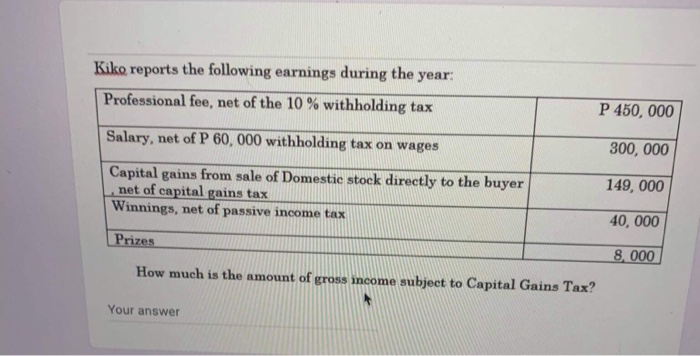

Salary and allowances of husband arising from employment. Net Capital gains from sale of shares of stock not traded in the stock exchange. If you lived in the residence for at least two out of the last five years the property is considered a primary residence and you may qualify for a 250000 deduction 500000 for married couples from any gain you had on the sale of the property.

Capital gains are subject to CIT taxed at 25 there is no corporate capital gains tax in Uruguay. Typical tax computation for 2021 Assumptions. Now that you know the basics of capital gains tax its time to know how to compute for it.

The rate is 6 capital gains tax based on the higher amount between the gross selling price or fair market value. Lets assume that you are not engaged in a real estate business and you have a 100 square meter residential property in Quezon City that you are selling for Php 200000000 2 million pesos.

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Capital Gains Tax Japan Property Central

Capital Gains Losses From Selling Assets Reporting And Taxes

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax In The Philippines Rate To Use How To Calculate And Pay Foreclosurephilippines Com

How To Compute File And Pay Capital Gains Tax In The Philippines An Ultimate Guide Filipiknow

Solved Ms Abc A Resident American Had The Following Chegg Com

Solved Ms Abc A Resident American Had The Following Chegg Com

Tax Updates July 2021 Syciplaw Tax Issues And Practical Solutions T I P S Vol 11 Tax Philippines

Income Tax Problems Bachelor Of Science Nursing Bsn Studocu

Understanding Your Tax Forms 2016 1099 Div Dividends And Distributions

Capital Gains Tax How To Fill Up Bir Form 1706 Youtube

Solved Ms Abc A Resident American Had The Following Chegg Com

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

How To Calculate Capital Gains Tax H R Block

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Taxes And Title Transfer Process Of Real Estate Properties This 2021

Income And Withholding Taxes Ppt Download

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes